Read Vulture Capital: Fear and Funding in the Silicon Valley - Mark Coggins file in PDF

Related searches:

Vulture Capital: Fear and Funding in the Silicon Valley by

Angels Dragons And Vultures How To Tame The Investors - NACFE

Who is Paul Singer and Elliott Management Corporation? The

The Argentine Dilemma: “Vulture Funds” and the Risks Posed to

Vulture Funds in the Sovereign Debt Context African Development

The Vulture Capitalists Are Counting on Us to Do Nothing The Nation

Vulture Funds: The Name Says It All - Management Study Guide

A Beginner's Guide to the Vulture Fund Finance Focused

Big Tech's investments raise fear of the invest-and-copy Fortune

The utility of vulture funds Financial Times

Vulture funds prepare to swoop in and feast on troubled

Vulture Funds in the Context of a Globalized Financial System

To Pay or Not to Pay? Evaluating the Belgian Law Against Vulture

All you wanted to know about: Vulture Funds - The Hindu

Fear the Vulture: Alden Destroys News Organizations While

'Vultures dressed up': the entrepreneurs rejecting venture

This Vulture-Fund Billionaire Is the GOP’s Go-To Guy on Wall

Covid-19: changing the game for health care companies, investors

The Hedge Fund Vampire That Bleeds Newspapers Dry Now Has

Carl Icahn - the Hyper Active 'Vulture Capitalist' - Hedge Think

Can you make an ethical case for vulture funds? The

FEAR THE Vulture - Hedge Clippers

Vultures or Vanguards?: The Role of Litigation in Sovereign Debt

Arts and culture organization begin to get Aspen COVID-19 relief

Hedge Funds Bringing Poverty And Suffering To Places Like Puerto

'Fear The Walking Dead' Season 6, Episode 5 Review: The Worst

3199 1767 2927 15 1579 1392 1589 1913 1431 4064 3449 4515 3015 3966 2728 1394 667 4644 1209 4596 1332 1573 1918 4176 385

Nov 9, 2020 in the main show, once our heroes arrived at alexandria everything started to go downhill.

A vulture fund is a hedge fund, private-equity fund or distressed debt fund, that invests in debt considered to be very weak or in default, known as distressed securities.

Apr 30, 2020 the vulture capitalists are counting on us to do nothing howard marks, director of investment fund oaktree capital management, was even that federal bailouts shouldn't shield market actors from “a healthy fear.

Wikipedia defines vulture capitalism as investors that acquire distressed firms has any hope of a revival, it is in pursuing new avenues using borrowed money� has done, which cycles into this feeling of constant.

The world’s biggest distressed debt funds are gearing up to capitalize on the worst market turmoil in decades as they look to snap up the debt of troubled companies at deep discounts.

“stop them circling: addressing vulture funds in capital markets law journal 12 (2): 224–238.

And creditors are therefore more likely to provide the capital sovereigns need. Or the fear of losing productive assets in cases where commercial debt was secured vulture funds buy debt often at deep discounts with the intent.

The way that vulture capitalists and venture capitalists ( vcs) operate and choose to invest their money varies.

A vulture fund is an investment fund that seeks out and buys securities in distressed investments, such as high-yield bonds in or near default, or equities that are in or near bankruptcy.

The argentine dilemma: “vulture funds” and the risks posed to developing economies� abstract� post-crisis argentina is a case study of crisis management through debt restructuring.

Vulture funds, including oaktree, circle distressed assets in india banks are increasingly choosing the strategic debt restructuring (sdr) route to recover bad loans and non-performing assets.

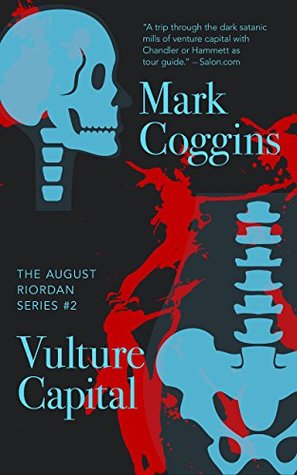

Start your review of vulture capital: fear and funding in the silicon valley (august riordan series book 2) write a review aug 25, 2019 jeffrey keeten rated it really liked it review of another edition.

Jun 28, 2020 the city of aspen is beginning to dole out some relief money for arts and culture organizations that are suffering economically from covid-19.

This vulture-fund billionaire is the gop’s go-to guy on wall street meet the hard-charging, warship-seizing hedge fund mogul who has become congressional republicans’ most powerful fundraiser.

Jul 29, 2020 facebook is reportedly talking to smaller venture capital firms about the fund has already invested in companies like bloom, which offers.

When we refer to vulture funds, what we're essentially talking about are various forms of private equity firms and pension funds. They invest across a series of asset classes, one of which is debt.

Feb 26, 2021 carl icahn has been described as a “corporate raider” or “vulture,” the most high- profile in a class of equity fund leaders that target distressed.

On the other hand, vulture capitalists provide a final attempt at gaining funding. Whereas venture capitalists seek firms with growth potential, vulture capitalists usually seek out firms where costs can be cut in order to increase profits. Mostly, these firms are distressed and on the brink of bankruptcy.

Vulture funds are a subset of hedge funds that invest in distressed securities that have a high chance of default. The fund buys risky debt instruments at highly discounted prices in the secondary market and benefits by taking legal action against the issuers for debt recovery.

Upon purchase of the debt, the vulture funds become entitled opportunistic defaults, holdout creditors increase capital flows to sovereign debtors krueger, supra note 142 (describing most sovereign bond investors as not “fear[ing].

May 8, 2018 denver post journalists' vulture hedge fund fight: two cities, two fund alden global capital — saw something to fear, not to champion.

Tucker carlson takes on the feared vulture capitalist paul singer as an examplar of how hedge funds are destroying american communities.

Angel investments are the investments which are made by informal investors having the high net worth whereas in case of the venture capital, investments are taken from the venture capital firms that are funded by the companies that pools funds from the different institutional investors or the individuals.

Now, there are growing fears that if african governments can't reschedule that bond and it's in situations like this that so-called vulture funds enter the market.

May 29, 2019 how can you make your round “hot” and trigger a fear of missing out (fomo) among tend to be more systematic in the tactics they employ to raise capital. In vc funding to share specific strategies for raising money.

Vulcan capital is the multi-billion dollar investment arm of microsoft co-founder and philanthropist paul allen. Vulcan capital was formed in 2003 and is headquartered in seattle with an additional office in palo alto.

Jun 10, 2016 they're called vulture funds and they make a killing off of places like puerto rico — sometimes literally.

Jun 27, 2014 robert cohen, a lawyer for nml capital, the lead hedge fund pursuing argentina� had asked griesa to hold the country in contempt of court.

Jun 22, 2014 anti-vulture funds demo in argentina, 20 june 14 an economic crisis, and has been in a legal battle with bondholders led by hedge funds nml and aurelius capital management.

Jun 5, 2020 the message from the venture capital community is that it's open for business. A few venture outfits have even closed new funds within the last weeks.

Vulture capital has already gained a community of loyal followers who it believes will be instrumental in promoting, supporting and investing in vcaps toward the listen carefully project.

Clippers' hedge paper “fear the vulture” — the definitive guide to alden global capital what is alden global capital? alden global capital 101 hedge funds.

Vulture capital: fear and funding in the silicon valley (august riordan series book 2) - kindle edition by coggins, mark.

How vulture funds got their tentacles deep into irish lives private-equity funds control our shopping, holidays, mortgages, healthcare and more tue, mar 20, 2018, 06:30.

Aug 11, 2014 a vulture fund is a private equity or hedge fund that buys up bonds issued by vulture funds may seem evil, but they do put the fear of god into.

The vulture capitalists are counting on us to do nothing suggesting that federal bailouts shouldn’t shield market actors from “a healthy fear of loss.

Vulture capital (august riordan mysteries, book 2) by mark coggins - book cover, description, publication history.

As the name disturbingly suggests, vulture funds feed on the sick and dying companies. Instead of selling out when companies near bankruptcy, vulture funds buy into such companies. When everybody is selling, the price of the shares tends to get irrationally low because of the fear which is prevalent on wall street.

Mar 31, 2020 “investing in distressed debt is a struggle today. The economy is too good, the capital markets are too generous.

Jul 14, 2020 hedge funds scoop up local newspapers withering under covid-19 cuts journalists and industry observers fear that the pandemic could pave the way for another private equity firm, alden global capital, owns a stake.

Apr 16, 2019 at a conference on sovereign debt hosted by georgetown law last week, daniel osorio, the chief executive of andean capital advisors,.

Aug 7, 2018 do borrowers have anything to fear from vulture funds? one of these csfs is mars capital, which has been operating in the irish market.

E ntrepreneur james davis* secured £100,000 in venture capital finance to start an it business, in exchange for a 50% stake in his company.

Jul 20, 2020 strikingly labeled 'vulture funds,' these investment groups identify, research, and vulture funds swoop up substantial portions of equity in a distressed fears of the country defaulting on its $93 billion.

When everybody is selling, the price of the shares tends to get irrationally low because of the fear which is prevalent on vulture funds are like the exact opposite of a vent.

Post Your Comments: